On October 16th US lithium ion battery manufacturer A123 Systems announced that it had:

Entered into an asset purchase agreement with Johnson Controls, Inc., which plans to acquire A123’s automotive business assets, including all of its automotive technology, products and customer contracts, its facilities in Livonia and Romulus, Mich., its cathode powder manufacturing facilities in China, and A123’s equity interest in Shanghai Advanced Traction Battery Systems Co., Alpha’s joint venture with Shanghai Automotive. The asset purchase agreement also includes provisions through which Johnson Controls intends to license back to A123 certain technology for its grid, commercial and government businesses. A123 also continues to engage in active discussions regarding strategic alternatives for its grid, commercial, government and other operations, and has received several indications of interest for these businesses.

To facilitate the transaction process, A123 and all of its U.S. subsidiaries have filed voluntary petitions for reorganization under Chapter 11 of the U.S. Bankruptcy Code in the U.S. Bankruptcy Court for the District of Delaware. A123’s non-U.S. subsidiaries were not included in the filing.

Whilst A123 were working their way through Chapter 11, they did manage to find the time to make “the business case for grid energy storage” in Energy World magazine, concluding that:

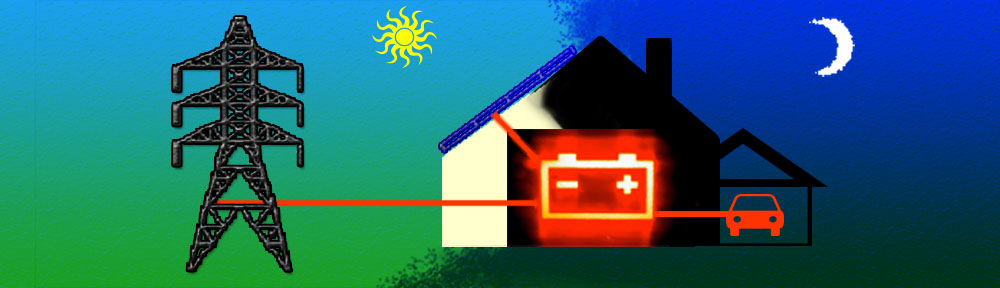

Utilities and power producers all over the world continue to deploy systems that demonstrate the versatility, reliability and efficiency of energy storage. The applications that advanced energy storage technology can provide combining multiple functions, can create multiple revenue streams and further enhance the economic benefits of energy storage as an integral grid asset.

Matters have moved on since then however, and A123’s own revenue streams seem to have proved sadly inadequate. In a new press release A123 now say that:

It has reached agreement on the terms of an asset purchase agreement with Wanxiang America Corporation (“Wanxiang”) through which Wanxiang would acquire substantially all of A123’s assets for $256.6 million. The agreement was reached following an auction conducted under the supervision of the United States Bankruptcy Court for the District of Delaware (the “Court”). A hearing at which A123 and Wanxiang will seek the required Court approval of the sale is scheduled for Tuesday, December 11, 2012.

Excluded from the asset purchase agreement with Wanxiang is A123’s Ann Arbor, Michigan based government business, including all U.S. military contracts, which would be acquired for $2.25 million by Navitas Systems, a Woodridge, Illinois based provider of energy-enabled system solutions and energy storage products for commercial, industrial and government agency customers.

According to Pin Ni, the president of Wanxiang America:

We believe that A123’s industry-leading technology for vehicle electrification, grid energy storage and other industries complements Wanxiang’s strong R&D and manufacturing capabilities, so we think adding A123 to our portfolio of businesses strongly aligns with our strategy of investing in the automotive and cleantech industries in the U.S. We plan to build on the engineering and manufacturing capabilities that A123 has established in the U.S. and we are committed to making the long-term investments necessary for A123 to be successful.

Pin Ni may have to put the champagne on ice for while though, since the deal isn’t all signed and sealed just yet however:

The completion of the sale to Wanxiang is subject to certain closing conditions, including approval from the Court as well as from the Committee for Foreign Investment in the United States (CIFIUS). Because the total purchase price for A123’s assets would be less than the total amount owed to creditors, the Company does not anticipate any recoveries for its current shareholders and believes its stock to have no value.

This doesn’t sound like wonderful news for the hard pressed U.S. taxpayer either. A123 don’t refer to this aspect of things, but according to Reuters:

The U.S. Energy Department will not give A123 Systems Inc. the balance of a $249 million grant. Republicans lawmakers, meanwhile, renewed criticisms that the White House’s clean energy grant to the maker of lithium ion batteries for electric cars had wasted taxpayer money. The company had received about $133 million of its $249 million grant when it filed for bankruptcy protection in October.

Pin Ni, president of Wanxiang America, said his company would respect the decisions made by the DOE.

A123 declined to comment.